Accept Cookies?

We use cookies to personalize content and ads, provide social media features, and analyze our traffic. Click accept to agree to our use of cookies as per our Cookie Policy.

Stay Ahead. Stay Trendy

Table of Contents

ToggleYour 401(k) represents one of your most important financial assets, yet many Americans unknowingly expose their retirement savings to unnecessary risks. Understanding these potential pitfalls—and how to avoid them—could make the difference between a comfortable retirement and financial uncertainty in your golden years.

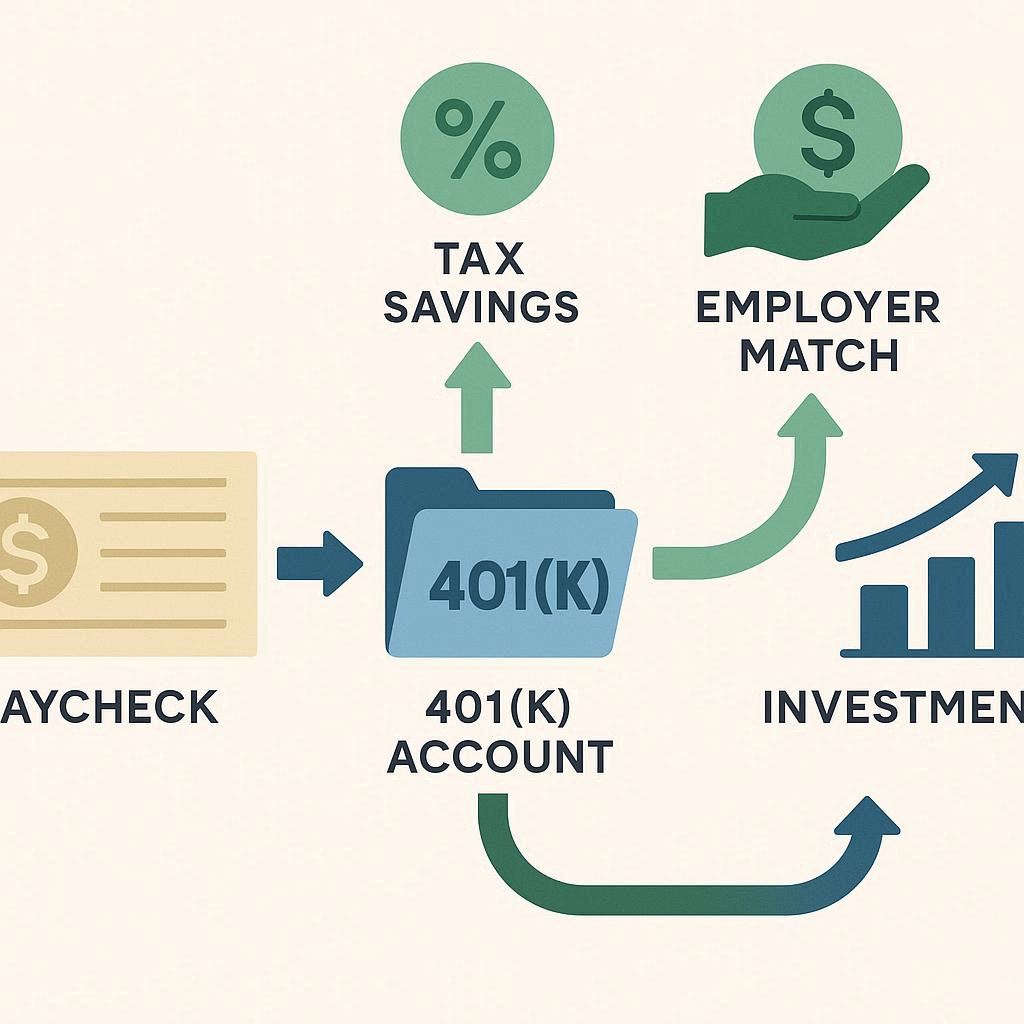

A 401(k) is an employer-sponsored retirement savings plan that allows you to set aside pre-tax dollars from your paycheck for retirement. Named after the section of the tax code that created it, this powerful financial tool has become the backbone of retirement planning for millions of Americans.

Here’s how it works: You contribute a percentage of your salary to your 401(k) account, often with your employer matching a portion of your contributions. These funds are then invested in various options chosen by your plan administrator, typically including mutual funds, index funds, and sometimes company stock.

The immediate benefit is clear—your contributions reduce your current taxable income. If you earn $60,000 and contribute $6,000 to your 401(k), you only pay taxes on $54,000 of income. Your investments then grow tax-deferred until you withdraw them in retirement, ideally when you’re in a lower tax bracket.

While 401(k) plans offer significant advantages, several risks can erode your retirement nest egg if left unaddressed. Let’s examine the most critical threats to your financial future.

One of the most overlooked risks is the impact of fees on your long-term returns. Many 401(k) participants don’t realize that seemingly small fees can cost them tens of thousands of dollars over their careers.

Common fee types include:

A difference of just 1% in annual fees can reduce your retirement balance by 25% over 35 years. For example, on a $500,000 balance, that’s $125,000 less for retirement.

Protection strategy: Review your plan’s fee disclosure documents annually. Look for funds with expense ratios below 0.5% for domestic stock funds and 0.75% for international funds. Consider low-cost index funds when available.

Many employees make investment choices without understanding the long-term implications. Common mistakes include being too conservative early in your career or too aggressive as you approach retirement.

Age-inappropriate risk levels can result in:

Protection strategy: Follow the general rule of subtracting your age from 110 to determine your stock allocation percentage. A 30-year-old might have 80% in stocks, while a 60-year-old might have 50%. Consider target-date funds for automatic rebalancing.

The biggest risk to your 401(k) might be not putting enough money into it. Many workers contribute just enough to get their employer match, missing out on years of compound growth.

Current contribution limits (2024):

Protection strategy: Aim to contribute at least 10-15% of your income to retirement accounts. Start with your employer match, then increase contributions by 1% annually until you reach your target.

Life happens, and sometimes 401(k) accounts look like accessible piggy banks. However, early withdrawals can devastate your retirement savings through penalties, taxes, and lost compound growth.

Early withdrawal consequences:

Protection strategy: Build an emergency fund outside your 401(k) to avoid the temptation of early withdrawals. Consider 401(k) loans only as a last resort, and understand the repayment requirements.

Putting too much of your 401(k) in company stock or a single investment type creates dangerous concentration risk. If your company struggles financially, you could lose both your job and a significant portion of your retirement savings simultaneously.

Diversification guidelines:

Failing to update beneficiary information can create legal complications and potentially costly delays for your loved ones. This oversight becomes particularly problematic after major life events like marriage, divorce, or the death of a beneficiary.

Protection strategy: Review and update your beneficiary designations annually and after any major life changes. Name both primary and contingent beneficiaries to ensure your wishes are followed.

Set aside time each year to review your 401(k) performance and make necessary adjustments:

If your employer offers matching contributions, prioritize getting the full match—it’s free money. A typical match might be 50% of your contributions up to 6% of your salary, effectively giving you a 3% salary boost.

Your 401(k) isn’t a “set it and forget it” investment. Market conditions change, new investment options become available, and your personal situation evolves. Regular engagement with your retirement plan ensures it continues serving your long-term goals.

While many 401(k) decisions can be made independently, complex situations may warrant professional advice. Fee-only financial advisors can help optimize your strategy without conflicts of interest.

Your 401(k) represents decades of work and sacrifice, making it crucial to protect this valuable asset from unnecessary risks. By understanding these potential pitfalls and taking proactive steps to address them, you can maximize your retirement savings and work toward the secure retirement you deserve.

Remember, the earlier you address these risks, the more time compound growth has to work in your favor. Start by reviewing your current 401(k) strategy, then implement changes gradually and consistently. Your future self will thank you for the attention you give to your retirement planning today.

The path to retirement security isn’t about perfect timing or exceptional returns—it’s about consistent contributions, reasonable fees, appropriate risk levels, and avoiding costly mistakes. By staying informed and engaged with your 401(k), you’re taking control of your financial future and working toward the retirement lifestyle you’ve always envisioned.

We use cookies to personalize content and ads, provide social media features, and analyze our traffic. Click accept to agree to our use of cookies as per our Cookie Policy.